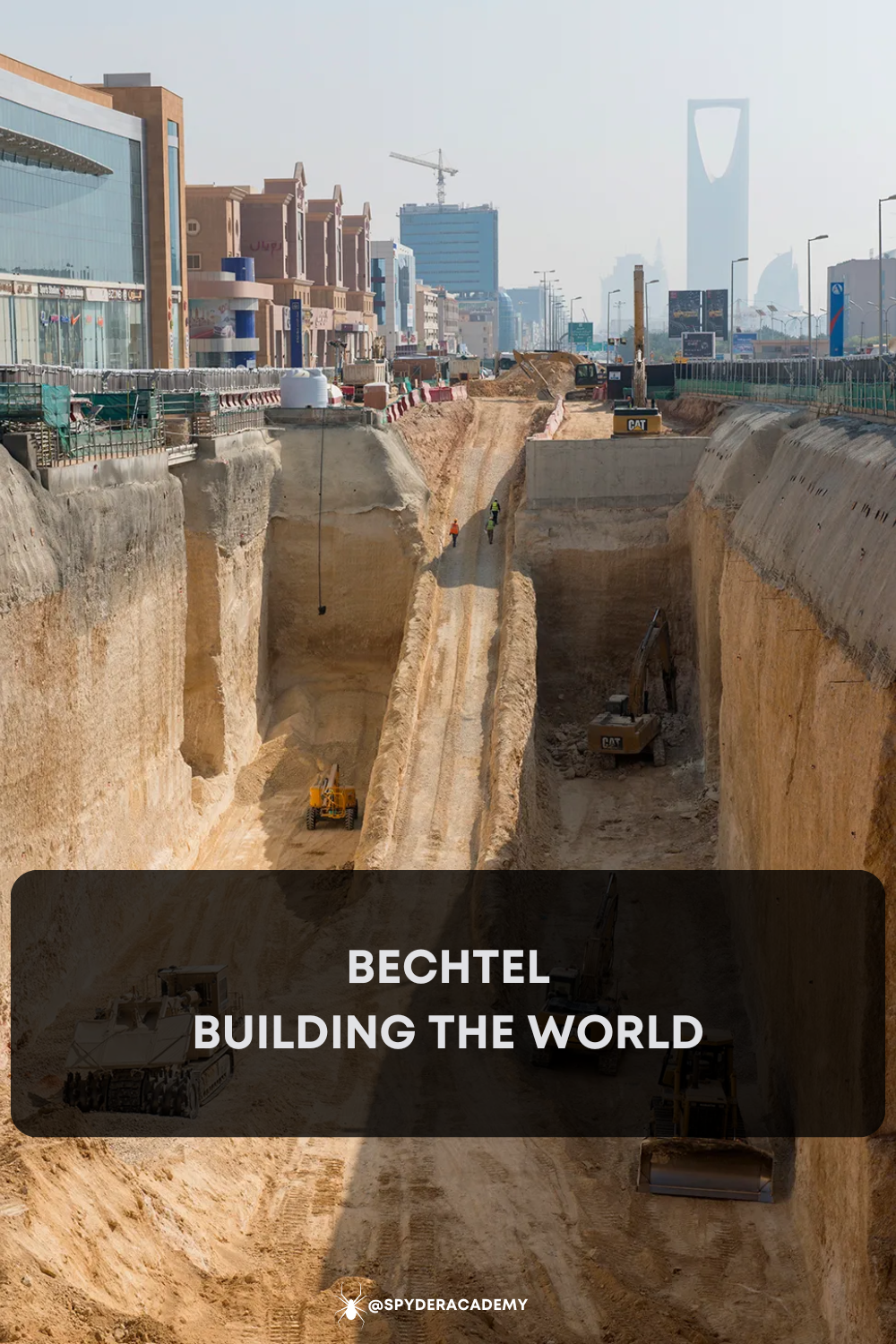

Bechtel: Building the World, One Massive Project at a Time

Hold onto your hard hats, folks! We’re diving into the world of infrastructure, a place where dreams become reality, and the only thing bigger than the projects is the impact they have. And leading the charge is Bechtel, a company so legendary, they make even the Hoover Dam look like a backyard swing set.

For over a century, Bechtel has been shaping the world, building things that make you go “Whoa, how’d they even do that?” From iconic structures like the Channel Tunnel (you know, the one under the English Channel) to power grids that light up entire countries, these guys are the real deal.

Now, while you can’t buy stock in Bechtel directly (they keep their secrets close, like a well-guarded tunnel system), there are publicly traded companies out there who are building empires in the same world. We’ll get to those later, but first, let’s get to know Bechtel, shall we?

Bechtel: The Construction Titan

Think of Bechtel as the construction crew that tackles the really big jobs. They work in everything from energy (powering those electric cars) to transportation (building those high-speed trains you keep hearing about) to water (making sure your shower doesn’t run dry). They’re practically everywhere, with offices and projects spanning over 160 countries. Talk about a global reach!

How do they make all that money? Well, they’re like the rockstar contractors of the world, taking on massive projects and getting paid for it. They’re not shy about charging a premium for their expertise, and they’re good at it. Plus, once they’re on the job, they’re known for doing it right, and that makes them valuable in the long run.

But let’s be real: Building isn’t all sunshine and rainbows. There are risks involved, and there are plenty of people out there trying to steal their thunder. Plus, the world is changing, and that means Bechtel has to change with it.

The Good, the Bad, and the Ugly

The Good:

- They’ve got experience. Like, a whole lot of experience. They’ve seen it all, and they know how to tackle the tough stuff.

- They’re innovative. They’re always looking for new ways to build better and faster, which is good news for everyone.

- They’re connected. They know everyone in the business, which helps them get the deals and make things happen.

The Bad:

- The world is a fickle beast. Economic downturns can throw a wrench in the works, and sometimes governments decide to spend money on other things.

- Competition is fierce. There are other construction companies out there, and they’re all fighting for the same contracts.

- Sustainability is a big deal. Everyone’s talking about it, and it’s important for Bechtel to be doing the right thing.

So, if you can’t invest in Bechtel, who can you invest in?

There are plenty of publicly traded companies that are building the world alongside Bechtel, and they’re offering investors a piece of the action. Think of them as the “Bechtel wannabes,” but they’re still pretty darn good at what they do. Some of these include:

- Fluor Corporation

- AECOM

- Jacobs Engineering Group

- KBR

- McDermott International

Bottom Line:

The world needs infrastructure, and there’s a lot of money to be made in building it. But remember, investing in any company is risky, and you should always do your research before making a decision. So, do your homework, stay informed, and watch those big machines roll!