JAB Holding Company: The Secret Empire of Coffee, Donuts, and Fancy Stuff

You know Krispy Kreme, right? Those delicious, melt-in-your-mouth donuts? Well, the folks behind them, along with a whole bunch of other famous brands, are part of a secret society (okay, not really a society, but you get the idea). It’s called JAB Holding Company, and it’s a private equity firm that’s like the Willy Wonka of the consumer goods world. They’re not just buying companies, they’re building a sugary, coffee-fueled empire.

Now, you can’t buy JAB stock directly because it’s a private company. Think of it as a VIP club, but with more donuts. But that doesn’t mean you can’t get a taste of the action. Let’s break down how this whole JAB thing works, shall we?

The JAB Family: A German Dynasty of Deliciousness

The JAB story starts with the Reimann family, who are like the Kennedys of consumer goods. They’ve been around since the 1920s, building a business empire brick by (coffee) bean by brick. This isn’t your average private equity firm, though. JAB takes a long-term approach to their investments. It’s less about flipping companies for a quick buck and more about nurturing them for long-term growth. They’re like the cool, patient aunt who lets you borrow her vintage Chanel handbag (but she expects it back in good condition).

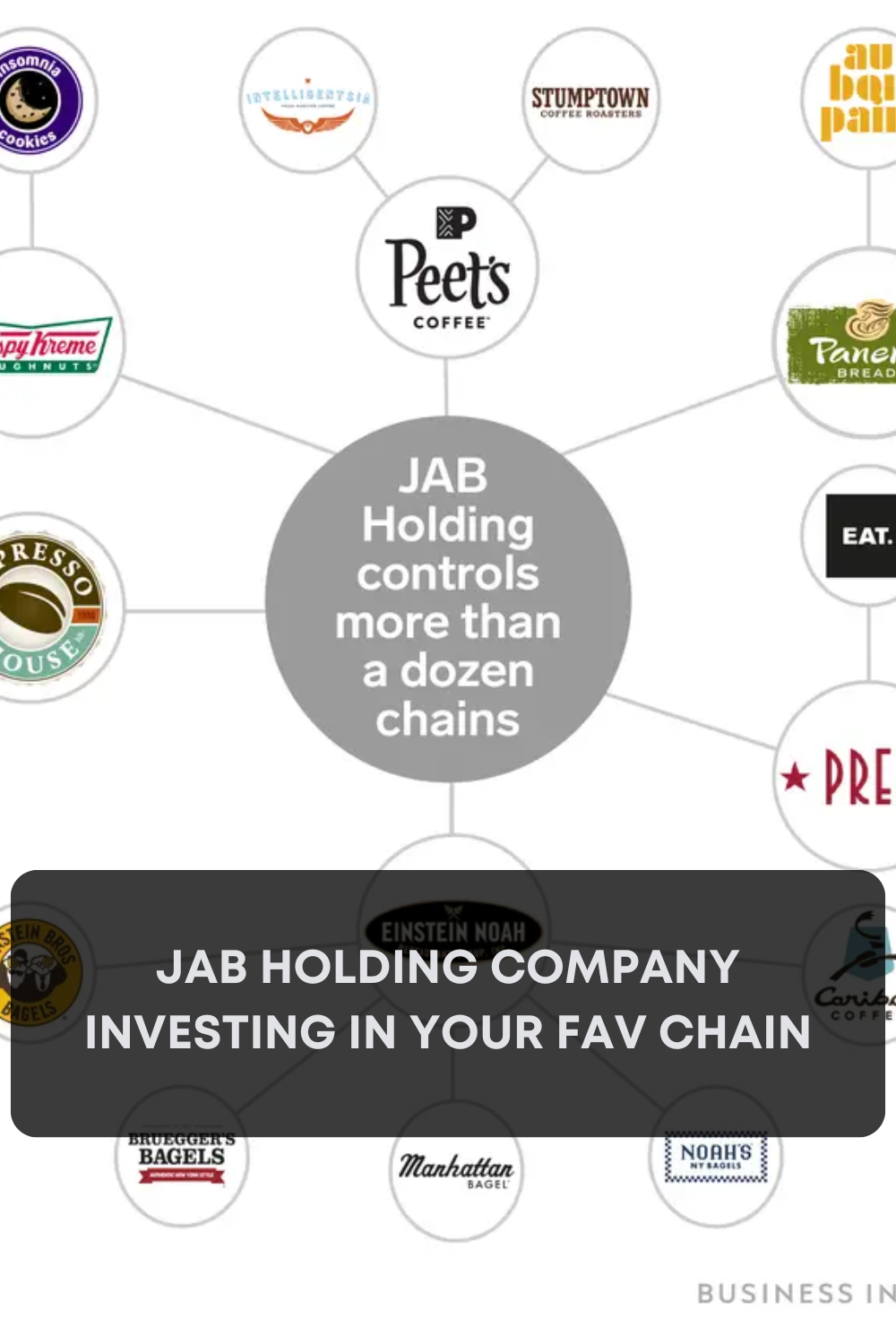

The JAB Portfolio: A Who’s Who of Iconic Brands

So, what exactly does this secret society own? Get ready for a sugar rush: Krispy Kreme, Peet’s Coffee, Coty (think beauty products), and even the Dr Pepper Snapple Group are all part of the JAB family. It’s a diverse collection of brands, but they all have one thing in common: they’re designed to make you happy (or at least get you through the day).

How JAB Makes Dough: The Secret Sauce

Think of JAB as a team of business wizards who go around finding companies with potential, then use their magic to make them even better. They tweak things, improve efficiency, and generally make the brands more awesome. It’s a bit like giving a classic car a high-end makeover.

But Can You Invest? Indirectly, Yes!

While you can’t buy JAB stock directly, there are a few ways to get a piece of the action.

- **Publicly Traded Companies: **Some of the JAB portfolio companies are publicly traded, like Coty and Keurig Dr Pepper. You can buy their stock on the stock market, but remember, these are individual companies with their own risks and rewards. It’s not a direct JAB investment.

- **Investment Funds: **Some funds might include JAB assets, but access to these is usually limited to big investors.

- **ETFs: ** ETFs that track broad markets or specific sectors like consumer staples might have a little JAB exposure.

- **Competitors: **Want to play the JAB game without directly investing in them? You can always invest in competitors, like other coffee or beauty companies. It’s a way to bet on the overall industry.

The JAB Potential: A Sugar-Coated Future

JAB has a solid track record, and their brands are in sectors with great potential. Consumer goods, luxury goods, and coffee are all industries that are expected to keep growing.

But There’s a Catch: The JAB Risks

Like any investment, JAB has its share of potential pitfalls:

- Debt: JAB has taken on a lot of debt to fund its acquisitions. This could be a drag on future growth.

- Competition: JAB competes in very crowded markets, so they have to constantly stay on their toes.

- Regulation: As JAB keeps growing, they may face more regulatory scrutiny.

- Divestitures: Sometimes JAB decides to sell off parts of their portfolio. This could create market volatility for those investing in their individual companies.

The JAB Bottom Line: A Sweet Ride, but Buckle Up

JAB Holding Company is a fascinating story of a private equity firm with a knack for building strong brands. While you can’t invest directly in JAB itself, you can still get a piece of the action through various strategies. But remember, no investment is without its risks. Do your research, talk to a financial advisor, and always remember: donuts are delicious, but don’t let the sugar rush cloud your judgment!